How Much Money Does Bjp Recovered From Bad Loans

The IBC provides for a time-bound resolution inside 180 days, and has a provision to extend the deadline by another ninety-days.

The IBC provides for a time-bound resolution inside 180 days, and has a provision to extend the deadline by another ninety-days.

The BJP claimed on its Twitter account on Saturday that the "Insolvency and Bankruptcy Code (IBC), 2016 has resulted in recovery of Rs iv lakh crore out of staggering Rs 9 lakh crore of NPAs or bad loans given to the corporates under UPA government."

As against this claim, the Reserve Bank of India's latest data shows that the public sector banks could recover a total of only Rs 15,786 crore in the fiscal year 2016-17 and 2017-18 till Dec 31 through all recovery channels, including IBC. Banks started referring bad loans cases for resolution nether the IBC since Jan 2017.

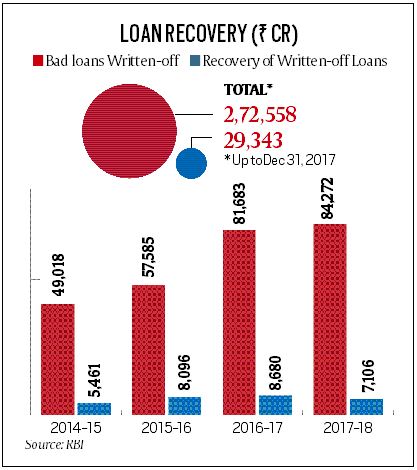

In fact, in the terminal four fiscal years — 2014-xv, 2015-16, 2016-17 and 2017-18 till December 31 — all 21 public sector banks in aggregate could recover only Rs 29,343 crore out of Rs 2.72 lakh crore of bad loans that were written off by the PSBs, as per the RBI information. During this 4 twelvemonth period, public sector banks recorded a recovery charge per unit of 10.77 per cent. This RBI data was presented by Minister of State for Finance Shiv Pratap Shukla in response to a query in Rajya Sabha on March 27. The information shows that more than than 89 per cent of the non performing assets (NPA) written off by state-owned banks could not be recovered during the period.

While the 12 big NPA cases are at various stages of resolution at benches of the National Company Law Tribunals (NCLT), the Economical Survey 2017-xviii released in January had analysed the commencement ten cases for which resolution plans were canonical under the IBC between August and December 2017. The IBC provides for a time-jump resolution within 180 days, and has a provision to extend the deadline by some other xc-days.

Best of Express Premium

Bold structural reforms by Prime Minister Narendra Modi government is leading to recovery of indiscriminate bad loans given to corporates under the UPA government, the BJP said in the tweet on its official Twitter handle @BJP4India on Sat. It was retweeted past BJP Odisha and some other party members. The tweet has later been deleted. When asked why this item tweet was deleted, BJP'south head of Information technology cell Amit Malviya said he was not aware of this. "I am not in the loop on this," he said.

As per the Economic Survey 2017-xviii, in the first ten cases, creditors were able to recover 33.53 per cent of full outstanding from the defaulting borrowers. Information technology showed that the creditors could recover Rs ane,854.xl crore out of the claims of Rs 5,530.xxx crore from companies including Synergies Doorey Automotive, Shree Metalik, Kamineni Steel & Power Bharat, Shirdi Industries, amongst others.

The other 12 large cases undergoing resolution nether NCLT involve claims worth over Rs 3.twenty lakh crore. Some of the cases which are close to resolution nether the IBC include Bhushan Steel, Essar Steel, Monnet Ispat and Energy, Binani Cement and Jaypee Infratech. It is not immediately articulate how much money will the banks be able to recover in these big cases.

With the RBI now pruning the avenues for restructuring stressed accounts and aligning NPA resolution with the IBC, the Code is emerging as the primary source of recovery for the cyberbanking sector. The RBI requires banks to implement a resolution program inside 180 days and in instance of non-implementation, lenders are required to file an insolvency application.

Source: https://indianexpress.com/article/business/banking-and-finance/insolvency-and-bankruptcy-code-bjp-claims-rs-4-lakh-crore-recovery-rbi-data-tell-a-different-story-5138768/

Posted by: closethruseell.blogspot.com

0 Response to "How Much Money Does Bjp Recovered From Bad Loans"

Post a Comment